“You aren’t wealthy until you have something money can’t buy.”

GARTH BROOKS

Welcome to our February newsletter

Well, this one’s a biggie. A real milestone. Not just any milestone – one of those giant ones, like the old mile markers on the Bruce Highway, the kind that made you sit up and take notice.

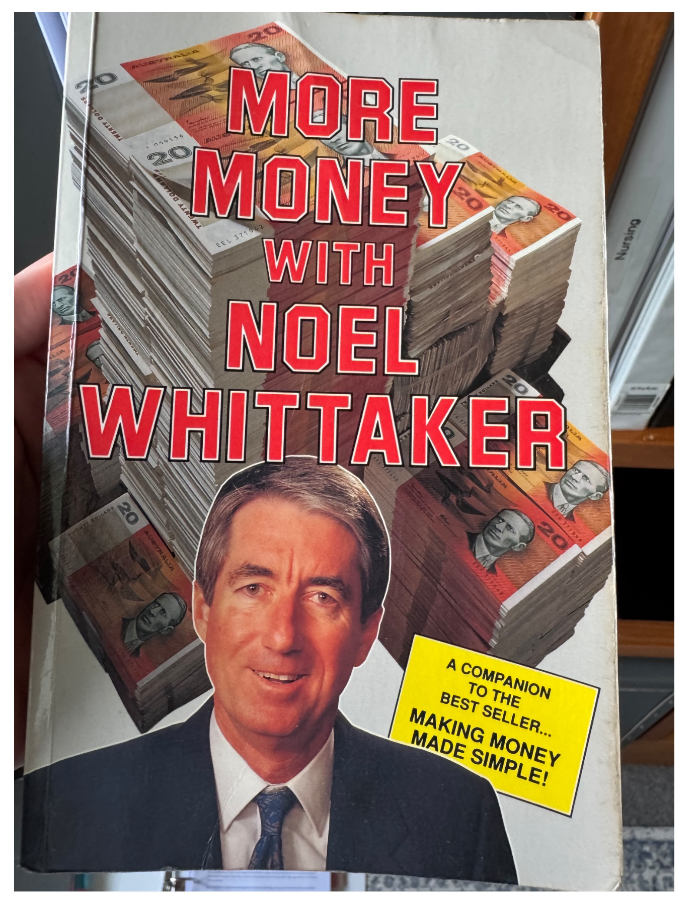

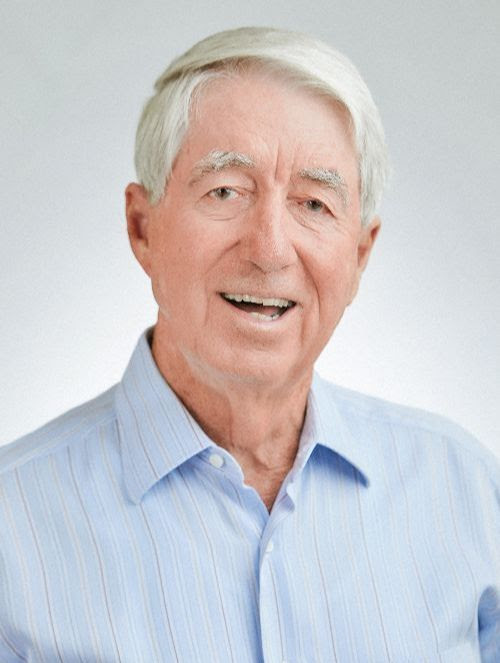

Because, believe it or not, I’ve just turned 85. And if that’s not enough to make you blink, this month also marks 50 years since I started writing for newspapers. Yes, it all kicked offback in 1975 with a humble little column in a local rag, and -well, you know how it goes – one thing led to another. Newspaper columns, talkback radio, and then books. Lots of books.

To mark the occasion, I’ve dug up a few photos – snapshots of the journey so far.

People often come up to me and ask, ‘So when are you going to retire?’ And I always givethem the same answer: Retire? What would I do that for? I love what I do! As long as I’vegot the strength, I’ll keep going.One of the greatest joys is hearing from people – folks who email to say my books changed their lives, or the ones who stop me in the street to tell me the same thing, right then and there. That’s what keeps me going.

And remember – financial knowledge is one of the greatest assets you can have. So don’t just keep it to yourself. Share it. Give a book to someone who needs it. You never know whose life you might change.

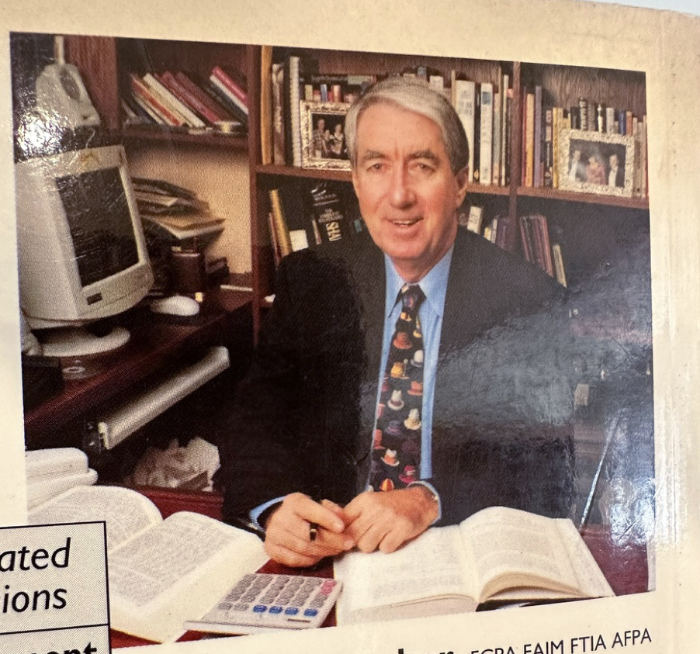

My second book came out in 1990 – just as I was turning 50.

Seems like a long time ago now.

This one was published in the Financial Review. It was taken in the study of our old home in Carindale, Brisbane. Have a look at the desk – notice how much computers have changed?

Now here’s a blast from the past – a roadshow in 1990. Can you pick the faces? From left to right: Ross Greenwood, Robert Gottliebsen, Michael Pascoe, David Koch, Jan Summers, and yours truly.

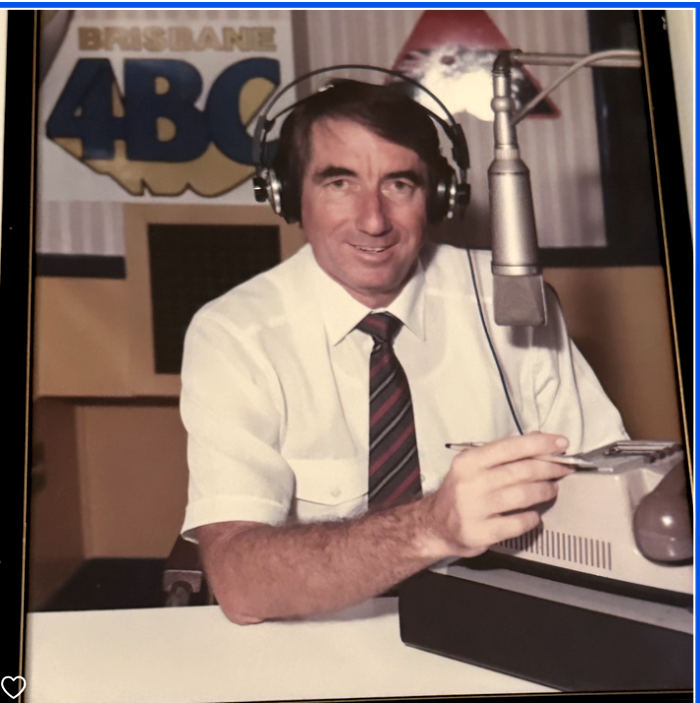

One of the things I’ve always loved doing – still do, in fact – is talkback radio on 4BC.

It kicked off at 6am every Saturday morning. People used to say, “Who’d listen to a money show at that hour on a Saturday?” They forgot that plenty of folks would roll home late on Friday night, forget to turn off their alarm, and – there they were – wide awake. And in those pre-internet days, you needed to tune in for the fishing tips and the scratchings.

It turned out to be a huge audience. And that’s where the idea for Making Money Made Simple first took shape.

The Podcast

Renowned broadcaster John Deeks and I discuss all the big topics covered in this newsletter in detail each month.

Staying healthy for longer

For more than half a century I’ve been writing about ways people can become financially savvy, manage their money and secure a prosperous future. Financial health is vital – but honestly, wealth means little if you don’t have the good health to enjoy it. As we all grow older, many retirees seem to be shifting focus from building wealth to figuring out how to live a longer life.

But let’s not kid ourselves: a long life needs to be a happy one too. I can’t think of anything worse than becoming like Bryan Johnson, a 45-year-old tech entrepreneur who’s reportedly spending millions trying to cheat death. Apparently, this poor fellow even goes so far as to ingest blood from his father and son in some bizarre ritual so that he can ‘live forever’. If that’s what it takes, I’d rather go out with a smile and die young.

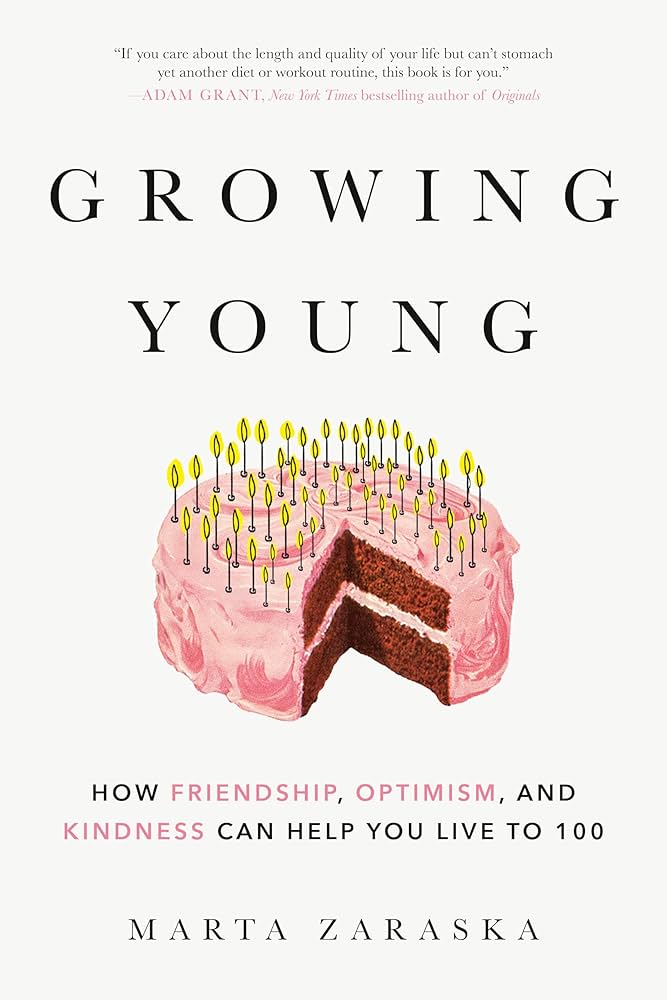

Over the years, I’ve gathered a library of books on how to live longer. They’ve started to blend; they all sing the same tune. But last week, I stumbled across an absolute game-changer: Growing Young by Marta Zaraska. The cover and blurb grabbed me right away: If you care about the length and quality of your life but can’t stomach yet another diet or workout routine, this book is for you.

Zaraska agrees that exercise and diet are crucial for a long, healthy life but points out that they aren’t the whole story. This eye-opening book explores how relationships, kindness and mindset can profoundly impact well-being.

It’s not all brand-new material. In Retirement Made Simple I wrote about a 2014 study by Dr Gillian Sandstrom, from the University of Essex, who found that casual encounters with acquaintances – like neighbours, baristas or gym classmates – boost happiness and a sense of community. Her research shows that talking to strangers fosters connection and contentment, challenging the notion that such encounters are trivial or unworthy of our time. Dr Sandstrom pointed out that speaking to even one new person weekly can bring unexpected joy and meaning into your life.

Image by tirachardz on Freepik

Image by tirachardz on Freepik

What makes Growing Young unique is its explanation of how everyday events influence your body’s chemistry. For instance, smiling at someone – a stranger or a supermarket cashier – triggers the release of chemicals like oxytocin, dopamine, and serotonin in both you and the other person. These chemicals promote happiness, bonding, and well-being.

In contrast, stress triggers cortisol, the ‘stress hormone’, which can lead to anxiety, increased heart rate and long-term health problems when elevated chronically. This dynamic highlights the profound impact of our interactions and emotions on physical health.

A key takeaway is that humans are wired for connection. Loneliness, Zaraska explains, is as harmful as smoking, while strong relationships can add years to life. For retirees, replacing workplace interactions with hobbies, volunteering or community groups can greatly enrich life. Zaraska also highlights how viewing retirement as an opportunity rather than a decline predicts longer, healthier lives.

The book’s case studies and conclusions are compelling. A profound message for retirees is to consider more than climate or cost of living. Key questions include: What activities foster connections? How does the environment support purpose? Equally important, what will your partner’s social life look like if you pass away first?

Reading Growing Young is like following a roadmap to aging well. Zaraska’s insights are grounded in robust science but remain accessible and engaging. The book reminds us that aging doesn’t mean growing apart. The choices we make today – nurturing relationships, fostering positivity and staying engaged – can profoundly shape our future years.

Taxes on super

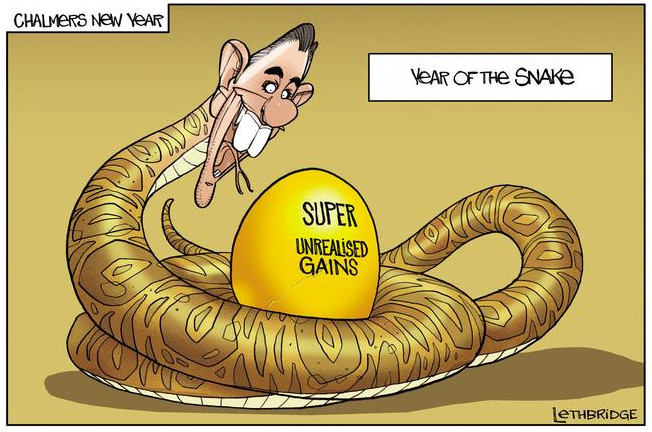

There’s been much discussion about the tax on unrealised capital gains for those with superannuation balances exceeding $3 million on 30 June 2026.

Opposition to this measure seems to be increasing as people recognise its unfairness, but we’re not in the clear yet. I understand some independents remain undecided. If you can, I recommend speaking with your local federal member. The only positive news is that the opposition has pledged to prevent this law from being enacted if they win government.

Image by Brett Lethbridge

Image by Brett Lethbridge

Story time

From one of my readers:

“We needed to update our wills, so I bought Wills, Death & Taxes Made Simple.

“We needed to update our wills, so I bought Wills, Death & Taxes Made Simple.

I wanted my eldest daughter in WA as executor, but she wasn’t sure about the role. I told her to read your book first. Big mistake – now she’s demanding all sorts of lists and flying over next month to check on me! Lucky I keep good records.

We decided on a joint bank account so she could access funds if needed. Then, last night, I reread your book and saw the reader’s tale about joint account nightmares (p.147). That got me worried. I went to the Bank of NSW, where she banks. “Both of you need to be here,” they said. Not possible. Heritage Bank said the same. CBA? Forget it – three local branches closed, service long gone.

Then I remembered the CBA at Goodna in Brisbane, where I used to bank. I dropped in and explained. The young teller frowned, ducked off to the manager, then reappeared with CBA Form 3552. We filled it in, and he uploaded it to my portal. “She won’t have a problem,” he said.

Sceptical, I emailed her a copy. Sure enough, the first teller at CBA in Kalgoorlie said, “Never seen this before.” But an older staffer knew the system, checked the portal, and there it was. Her details were already on file from an old account, but nobody asked why she’d moved to the Bank of NSW.

Now, I’m off to ask the local Bank of NSW why they don’t have a form like CBA 3552. Wish me luck!”

I’m just glad they got the chance to sort this out now rather than later.

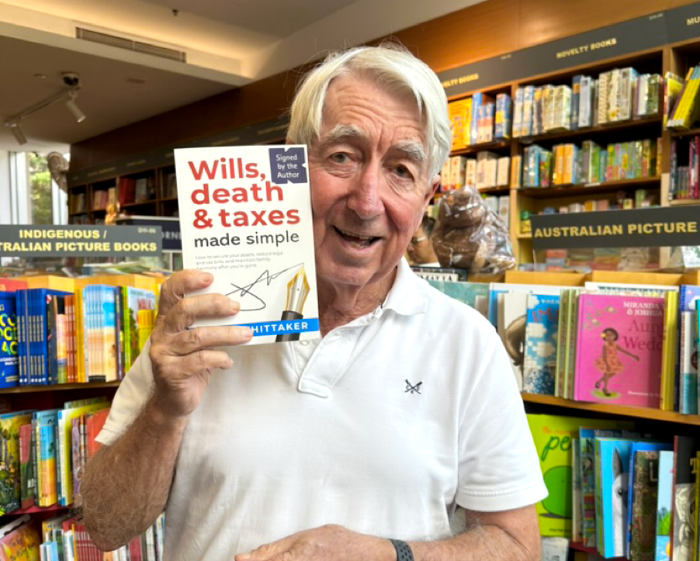

It just happened. I was in Sydney last weekend and came across the Kinokuniya bookstore hidden away on the third floor of a building at 500 George Street, Sydney right opposite the Queen Victoria building. It’s a huge operation – like a Costco for books.

I introduced myself and they gave me a big welcome, and asked me to sign some books. They also told me Wills, death & taxes made Simple was one of their best selling books. This is unique publication and is a must for every household.

It’s available from my website and much cheaper if you buy bundles as we pay the postage.

The automatic renewal scam

The digital age has brought us many conveniences, but it’s also opened the door to new forms of exploitation. One of the most pervasive is the con of automatic renewal payments. The root of the problem lies in the system that conditions us to mindlessly accept terms and conditions, often without a second thought.

Image by Freepik

Image by Freepik

Whether it’s approving the latest software update or simply reserving a restaurant table, we’re all too familiar with the endless ‘I agree’ checkboxes. These terms and conditions can – in theory – be read elsewhere, but hardly anybody does. And that’s not by chance, but by design. Most are as long as a novel and full of legal jargon. It’s no wonder that, according to a Deloitte survey, over 90% of consumers accept terms and conditions without reading them, highlighting just how widespread this issue is.

A particularly sneaky tactic is the so-called ‘free trial’. Whether it’s for seven days, fourteen days or a month, the process is always the same. You’re required to subscribe, providing your payment details up front, then cancel within the specified timeframe if you’re not satisfied. Of course, life gets busy, and before you know it, the trial period has lapsed. Suddenly, you’re hit with an automatic renewal notice for a service you didn’t even realise you’d agreed to continue.

This scenario is not hypothetical – it’s personal. In the last month alone, I’ve fallen victim to it twice. The first time was with SurveyMonkey, a popular website for creating surveys. The second was with MyHeritage, a platform for tracing your ancestry. Both instances highlight how these systems are rigged against consumers and exploit user oversight of the terms and conditions.

SurveyMonkey hit my American Express card for a charge I was confident I hadn’t approved. I rang up American Express and told them to reverse it. Their response? ‘SurveyMonkey says you authorised it.’ How? By clicking a link, apparently. After 30 years as a cardholder without ever disputing a charge, you’d think they’d give me the benefit of the doubt. Nope. It wasn’t until I lodged a complaint with the Australian Financial Complaints Authority (AFCA) and pushed back that American Express finally refunded the money.

MyHeritage was worse. They took $407. When I called them out, they smugly pointed to their automatic renewal terms. I threatened to take it to AFCA if they didn’t give me a refund. First, they offered to refund 50%. I said no. Eventually, they caved and refunded the full amount. But it shouldn’t take this level of persistence to get your money back.

These stories are just the tip of the iceberg. Companies are banking on us being too distracted or too busy to notice these sneaky charges. And why wouldn’t they? The system is set up to exploit us. The Australian Competition and Consumer Commission (ACCC) reports that over 30% of consumer complaints involve unauthorised charges linked to automatic renewals.

But let’s face it: we can’t solve this problem one consumer at a time. We need regulators to step up. Opt-in renewals, clearer disclosures, and stricter rules around subscription transparency are essential. The UK has already introduced stronger protections in this area. It’s time Australia followed suit.

Until then, stay sharp. Be the squeaky wheel. Because if we don’t hold these companies accountable, who will?

Secrets of sleep

Quality sleep is about the most important thing you can do for your health – so I’m thrilled to highlight my son James’s latest Win the Day podcast.

This time, he’s chatting with Dr Michael Breus – a double board-certified Clinical Psychologist and Clinical Sleep Specialist. I thought it was brilliant.

They go through all aspects of sleep, including supplementation (magnesium, melatonin, sleeping pills, etc.), the best time to go to bed and wake up, how to fall asleep on an airplane, and tips for shift workers.

It’s a cracking one-hour listen:

Dr. Breus also shares numerous valuable tips on overall health and well-being, such as hydration, breathing, and energy.

Geraldine and I learnt so much. For instance, I never knew the dangers of blackout curtains or how melatonin can react with prescription drugs. No one tells you these things!

You can watch the full episode on YouTube here.

Saving capital gains tax

In my last newsletter I briefly mentioned using catch-up contributions to save capital gains tax. In response to many emails asking for information I’m now putting the detail in here.

Nobody likes paying tax, and capital gains tax (CGT) is one of the most disliked, but actually, CGT is the best of taxes. It is not payable until you dispose of the asset and provided you have kept it for at least a year you get a 50% discount to allow for inflation. Furthermore, death does not trigger CGT, it merely passes the liability to the beneficiaries who receive the asset. They will pay CGT only when they dispose of it.

Image by kues1 on Freepik

Image by kues1 on Freepik

In fact, the only real catch is that realised capital losses die when you die, so if you have any capital losses, it’s a good strategy to sell some assets that have a capital gain prior to death, to offset the losses and reduce the tax payable.

CGT is relatively easy to minimise with some careful planning. Let’s look at a perfect case study, which involves the strategy of getting a tax deduction by making tax deductible (concessional) contributions to super. Bear in mind that the cap on concessional contributions (CCs) is rising from $27,500 a year to $30,000 a year on 1 July.

CASE STUDY

Jack and Jill have $800,000 and $300,000 in super respectively. They are both aged 66 and have been retired for five years. They wish to sell a property that will carry a capital gain of around $600,000. The first step is to defer signing any contract until after 30 June, when the personal tax rates drop. Then they discover they can make use of catch-up CCs, as they have made no CCs since they retired. You can make CCs until age 75, but if you want to claim a tax deduction for these contributions between ages 67 and 75, you must pass the work test, which only involves working at least 40 hours over 30 consecutive days. That’s an easy one.

To use catch-up CCs their balances must be under $500,000 by 30 June 2024. To become eligible, Jack withdraws $360,000 from his super before 30 June, which reduces the balance to $440,000 on 30 June 2024. They are now both eligible to make catch-up concessional contributions from 1 July 2024.

From 1 July 2024, the maximum period for unused CCs is the five financial years from 2019–20 to 2023–24. As Jack and Jill have not used any of the CC cap in those 5 years, the maximum catch-up CC is $132,500. This is in addition to the 2024–25 financial year’s standard $30,000 CC cap. This gives them the potential to make personal super CCs totalling $162,500 each and claim them as a tax deduction. Just be aware that in any year, you first use up the standard CC cap for the year, and only then can use your catch-up CCs.

In the 2024–25 year they sell the property for $1.3 million, which they bought in 2018 for $700,000. This creates a taxable capital gain of $600,000, which will be taxed as $300,000 each because the property is owned in joint names. The 50% discount applies, so only $150,000 will be added to each person’s taxable income in the current financial year. But in fact, the taxable gain of $150,000 each is wiped out using their standard CC caps of $30,000 for the year, and $120,000 of catch-up CCs. The total tax to pay is just $45,000, which is the 15% contribution tax.

Now I appreciate that not everybody has access to catch-up CCs, but almost everybody who is retired could reduce CGT by making a $30,000 concessional contribution for the year ending 30 June 2025. As always, take advice for your personal circumstances. Good advice doesn’t cost; it saves.

And finally

LEXOPHILIA – WHO ON EARTH DREAMS THESE UP? A lexophile of course!

How does Moses make tea? Hebrews it.

Venison for dinner again? Oh deer!

A cartoonist was found dead in his home. Details are sketchy.

I used to be a banker, but then I lost interest.

Haunted French pancakes give me the crêpes.

England has no kidney bank, but it does have a Liverpool.

I tried to catch some fog, but I mist.

They told me I had type-A blood, but it was a Typo.

I changed my iPod’s name to Titanic. It’s syncing now.

Jokes about German sausage are the wurst.

I know a guy who’s addicted to brake fluid, but he says he can stop any time.

I stayed up all night to see where the sun went, and then it dawned on me.

This girl said she recognized me from the vegetarian club, but I’d never met herbivore.

When chemists die, they barium.

I’m reading a book about anti-gravity. I just can’t put it down.

I did a theatrical performance about puns. It was a play on words.

I didn’t like my beard at first. Then it grew on me.

Did you hear about the cross-eyed teacher who lost her job because she couldn’t control her pupils?

When you get a bladder infection, urine trouble.

Broken pencils are pointless.

What do you call a dinosaur with an extensive vocabulary? A thesaurus.

I dropped out of communism class because of lousy Marx.

All the toilets in Kaiapoi police stations have been stolen. The police have nothing to go on.

I got a job at a bakery because I kneaded dough.

Velcro – what a rip off!

Don’t worry about old age; it doesn’t last.

I hope you have enjoyed the latest edition of Noel News.

I hope you have enjoyed the latest edition of Noel News.

Thanks for all your kind comments. Please continue to send feedback through; it’s always appreciated and helps us to improve the newsletter.

And don’t forget you’ll get more regular communications from me if you follow me on X – @NoelWhittaker.

Noel Whittaker