The meaning of life is to find your gift.

The purpose of life is to give it away.

DAVID MELTZER

Thank you so much

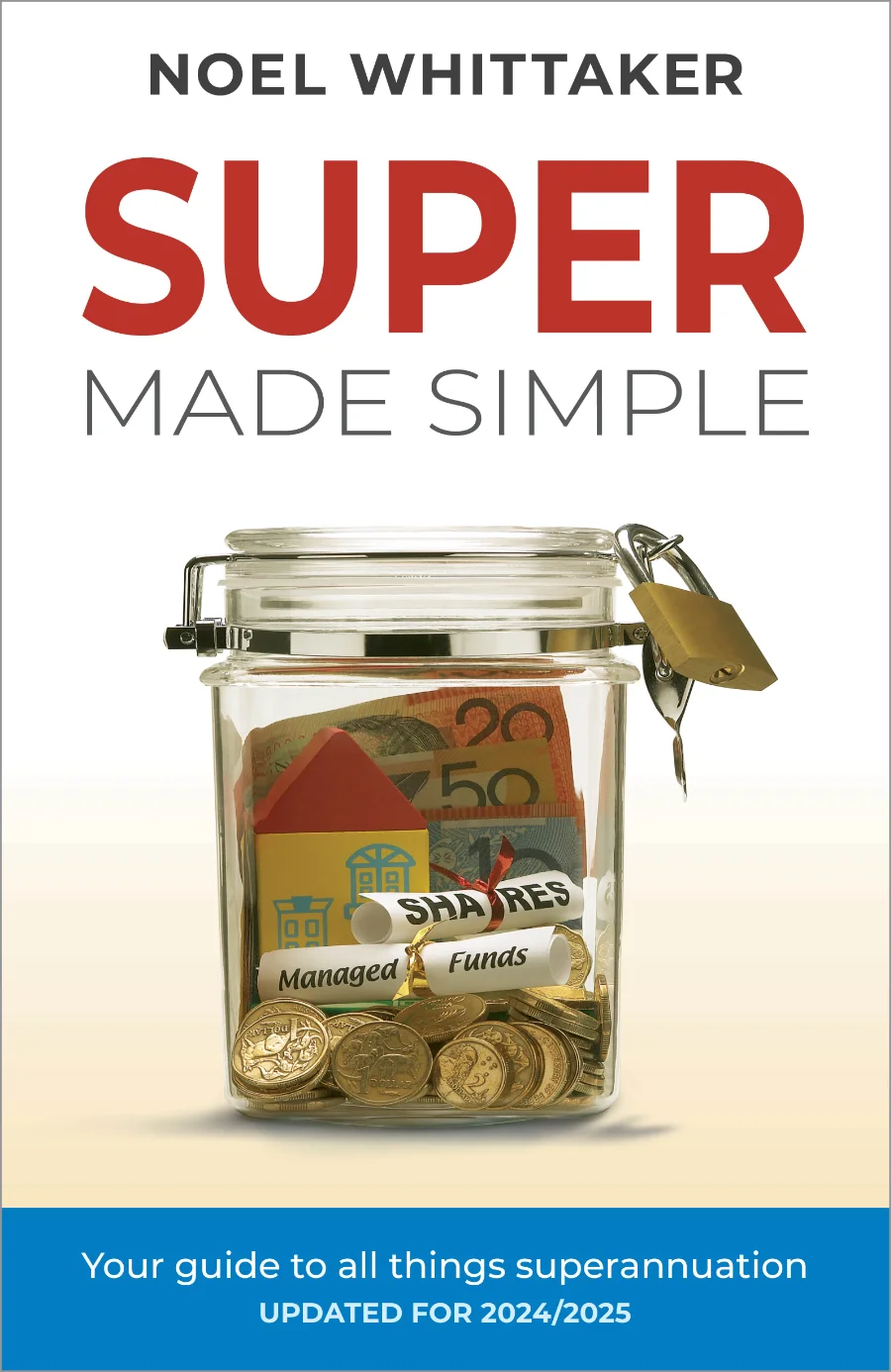

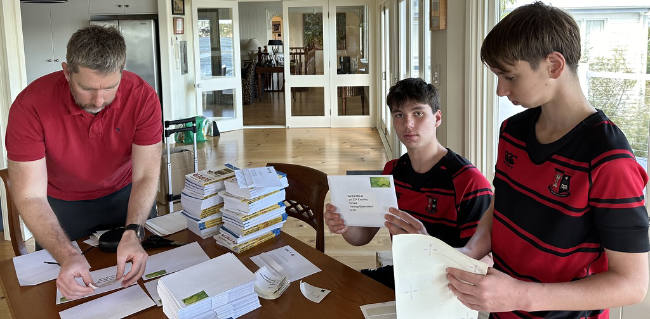

Thank you so much for your overwhelming support of the new edition of Super Made Simple. Within three days we had nearly 1000 orders and I had to recruit the entire family to help with the mailout.

Thank you so much for your overwhelming support of the new edition of Super Made Simple. Within three days we had nearly 1000 orders and I had to recruit the entire family to help with the mailout.

It did take a whole weekend, but it was a great experience for the grand kids to learn how business works and to earn some pocket money.

I had decided to handle the mailing of that special offer myself as I didn’t want to over burden Neil who packs all the other books. You may remember he broke his hip in March – he is indispensable.

Just don’t delay – the special deal, which was designed for the original buyers of Superannuation Made Simple, which is now out of date, will finish on the 6th of August.

Until August 6th the price of Super Made Simple print edition will be reduced from $29.95 to $19.95 and if you enter the coupon code SUPER at the cart on my website, you’ll get free shipping. This means you can have the new book delivered to your door for just $19.95.

We’re also reducing the price of the e-book. The 5th Edition Ebook was $16.95, but now the fully revamped 6th Edition for 2024-2025 is on for sale for $12.95. If you have purchased the 5th edition ebook in the last 3 months, keep an eye on your inbox for a special upgrade offer.

Take advantage of these specials or grab a bundle – now with extra savings (usually $49.99) and as always, free shipping.

VIEW ALL BUNDLES IN THE BOOK SHOP

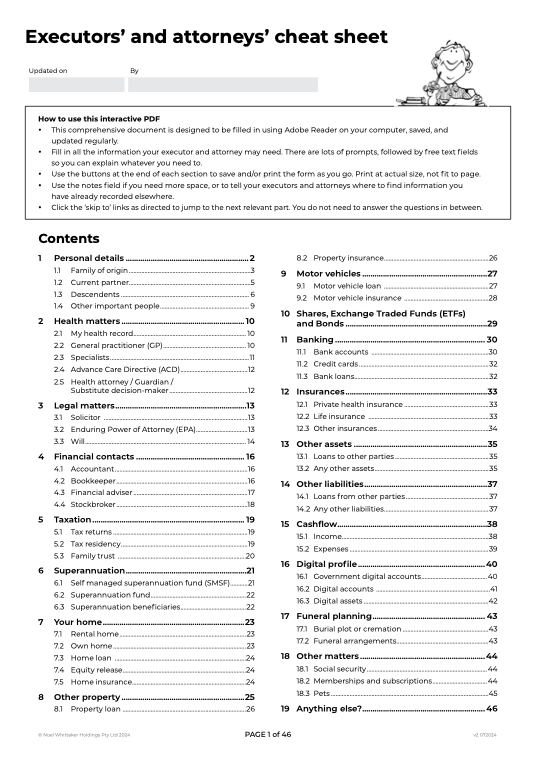

The Executors’ and attorneys’ cheat sheet

I have great news – after months of hard work, and many long nights, the Executors cheat sheet is a reality.

I thank you for your input but just bear in mind that there are space limitations. The document has grown to 46 pages which is more than we expected but I think it covers almost everything you’re going to need.

You can click on the link to download it, you can save the document and give it a name, print copies and retrieve it from your computer whenever you wish.

You can also find it and other resources on the Free Downloads page on my website.

Account based pensions – be prepared

Most retirees live on an account-based pension from their super fund, often supplemented by a part age pension. This usually works well until one of them dies, but at that point, if careful preparation has not been put in place, serious problems can emerge.

Image by Freepik

Image by Freepik

A common scenario is a couple who receive a part age pension and have assets of around $800,000 outside the family home. If they fall into the trap of leaving all their assets to each other, when one passes the surviving partner – usually a widow – finds themselves over the single person assets test cut-off point and they lose their age pension as well as their partner. That’s easily avoided by making sure the will is drawn in such a way that the total assets left to the survivor don’t take them over the single’s threshold. There are many ways this may be achieved, including by adding children as binding beneficiaries of the super account or income stream. This is a complex area, with varied taxation impacts depending on who superannuation assets are transferred to, so ensure you seek advice.

Another big issue is delays that occur in superannuation when a person dies. Most couples nominate their partner as the reversionary beneficiary or binding death benefit nominee, which means they take over the pension or receive the benefits directly when the main account holder dies. But this does not happen automatically.

First you need a certified death certificate, then probate. Next, you or your solicitor must apply to the fund for the pension to be changed from the deceased to yourself as surviving partner. You may also need to provide certified copies of the will. The paperwork is not normally a problem if you have a self-managed superannuation fund, but most people have their superannuation with one of the large superannuation funds and, like all large institutions, dealing with them can be time-consuming. In extreme cases, the transfer process can take years, which may leave you in real trouble if your income stream is suddenly reduced to a trickle.

If there is a reversionary nomination, the beneficiary will need to prove their identity for the account to revert to them, and for income payments to continue. As part of this process they will need to provide proof that they are an eligible reversionary (for example, a marriage certificate), and a death certificate for the deceased. These are legal requirements the fund has to follow. Any income payments that have been paused are then paid to the reversionary as part of the account transfer process.

If there is no reversionary nomination or binding death benefit nomination, the Trustee needs to do due diligence on who the death benefit should be paid to, which can take additional time and does not necessarily result in the best outcome for the family group. So it’s important to consider these aspects and document them appropriately in advance of something we all eventually share – our own mortality.

Image by atlascompany on Freepik

Image by atlascompany on Freepik

My key message here is that pension payments will stop as soon as your death is advised to the superannuation fund, and will not continue unless you have a reversionary nomination (for an account-based pension) or a spouse nomination (for a lifetime pension). To avoid any potential delays, it’s a good idea for executors to get onto the paperwork quickly. Turnaround times for death certificates vary for each state, but 2–4 weeks is common. It can be longer if the death occurred overseas. Probate can also vary, depending upon the workload of the courts and the efficiency of the solicitor.

To head off these challenges before they start, it’s a good idea to find out exactly what documentation your fund will need if one of you dies, then make sure it’s readily available. Furthermore, all retirees should keep money in cash outside super, that will be available immediately if needed. A joint account is ideal for this, as the survivor will retain access throughout. Estate planning is complex, so it’s imperative to seek advice that considers your individual circumstances and optimises your outcomes. A well-considered estate plan should minimise end taxes, ensure income streams continue efficiently, and maximise support from the government in the event of losing a loved one.

Feedback back from a reader on this article

“Two years ago I asked Australian Super for the relevant forms that would be applicable so that I can prepare any necessary forms and documentation to assist my executor/beneficiaries when I pass – their initial response was that Australian Super does not provide copies of such forms until the person actually passes away!

Their processes are so dis-functional, that upon lodging a complaint about the forms for “Claim upon Death”, they supplied the forms to me by email, but then stated that they were very sorry to hear of my death and immediately stopped my account based pension. It took me 18 months to have it revived.”

Channel Nine Today Extra Segment

Recently, I did a segment on Channel 9 regarding my new book. Click the button if you want to watch it. It’s only two minutes.

From the mailbox – what a classic!!

About a week ago my wife came home from a trip to the local public library with a usual bunch of books…she is an avid reader, mostly of fiction.

She said ‘I found a book you may like among the horror books at the library; it is written by an author you seem to like.’

‘Oh yes.’ I replied, ‘What is it about and who wrote it?’

‘I think it is about some guy called Will who died in a taxi. You know the author Noel Wickettaker.’

Well, she was right about one thing, it is a horror story.

Well, she was right about one thing, it is a horror story.

I thought I had covered everything with regard to dying. I had wills for both of us but after reading your book I thought I should check them, and I did. They had been drafted in September 1993!

Not only are they rather ancient, the Executors and Trustees are the lawyers who drew them up…one has been retired from the practice for several years and the other has a life-threatening illness and may not outlive us.

Apart from the wills there are many other things we need to do before we depart this mortal coil, even things like valuation of artwork purchased after 1985.

I won’t bore you with our story, but I must compliment you on a book that should be part of the curriculum of all schools. Well done Noel “Wicket-taker”.

Watch the interest

Image by luis_molinero on Freepik

Image by luis_molinero on Freepik

Financial decisions are becoming more complex. Whether you are deciding on a power plan, health insurance or the best bank account, there is such a baffling array of choices, that it’s almost impossible to make it a decision. Then as soon as you take the plunge and sign up, you are bombarded with a terms and conditions in tiny print and incomprehensible language.

Eight years ago my wife decided she wanted a bank account in her own name in case I suddenly dropped off the perch, leaving her destitute. I was then a St George private bank customer, so I sat down with my relationship manager to work out the best kind of account for her. He suggested a Special Savings Account, featuring a bonus rate, and we accepted his advice.

It’s an account that’s rarely been used, and we took little notice of it during those years when interest rates were around zero. But rates have bounced up again and I decided it was time to audit our personal finances.

The interest rates were clearly marked on the account, and the first thing I noticed was the current interest rate was 1.85% and the bonus rate was 3.3%. it didn’t take long to do a simple calculation which showed that the monthly interest was being credited at 1.85%, but there was no sign of bonus interest.

We all know that phoning a bank can be a long process, so I did it the easy way and submitted a complaint online. An answer came back quickly saying they would look at my request and get back to me within four working days.

Right on cue, last Monday night around six, I got a call from a nice young bloke from the complaints department. I pointed out that some years previously I had been ‘sacked’ as a private bank client, and consequently lost my relationship manager. A few years later, they closed my branch, leaving me with no contact option apart from phoning a call centre. This was the final straw, and I’d had very little contact with St George since that time.

He explained that the account’s terms and conditions required a monthly deposit to qualify for the bonus interest. I said that was news to me, but he took me back to the time when the account was opened, and pointed out that during the first two years of the account there had been a direct debit of $50 a month into the account from my personal account. After two years the scheduled payments automatically lapsed, as did our bonus interest. Obviously the monthly deposit requirement had been explained to me at the time and a debit set up to make it happen — but all that had been forgotten as the years passed.

We had a very civilised conversation, and the upshot was that he offered me a payment of $500 to compensate for the misunderstanding. He also pointed out that if I reinstated the periodical payment specifying an email receipt for each transaction, I would automatically be reminded when they expire.

This exercise just proves that inertia is one of our greatest enemies. Everybody in the financial services industry knows about the “loyalty tax” – the cost of being a loyal customer who accepts the status quo in the mistaken belief that the other side will have your best interests at heart. My advice today is to do an audit on your own bank accounts. It may be the most valuable hour you could spend.

A reader’s story

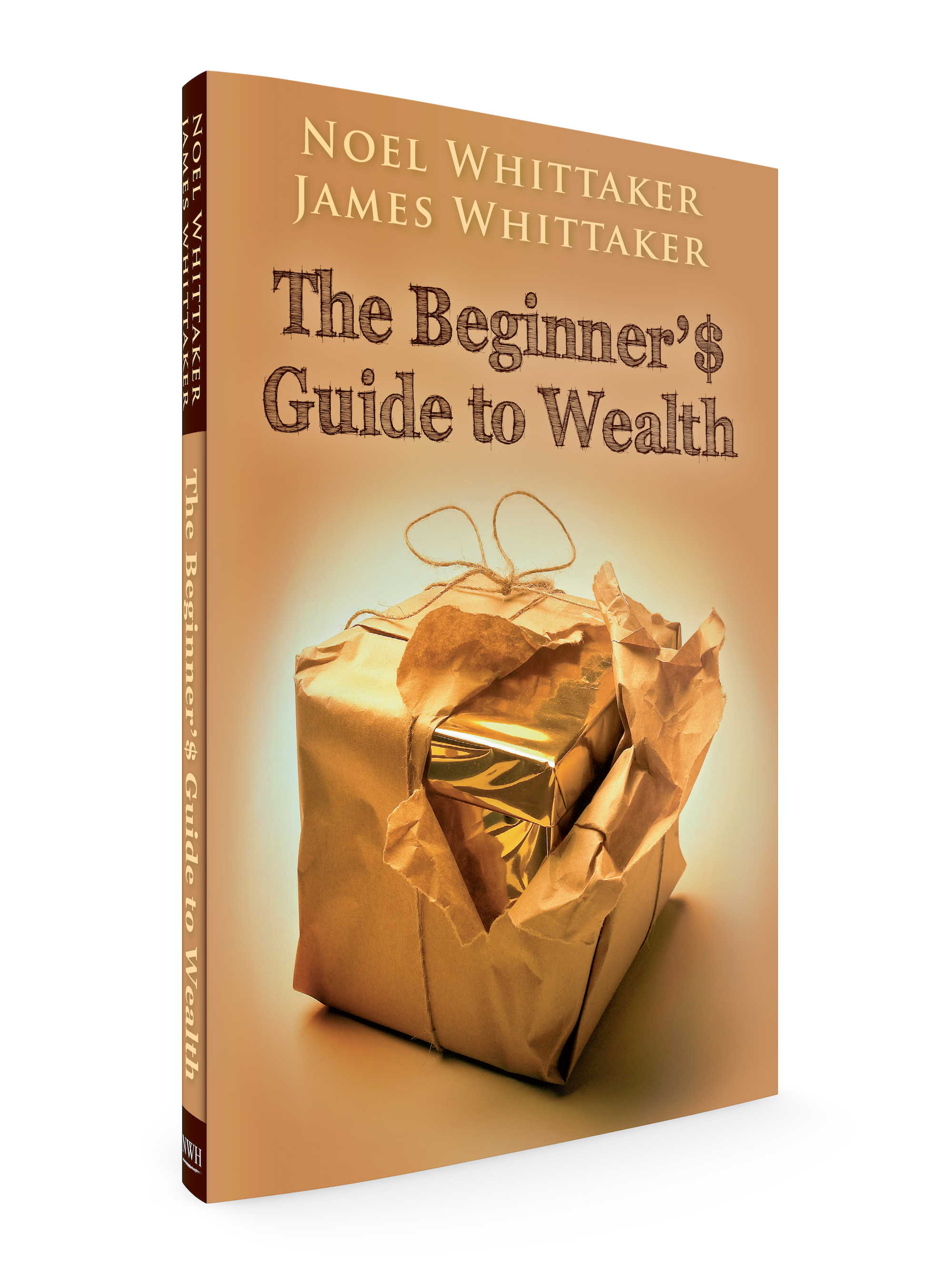

Thanks – In 2012, I picked up your book ‘Beginners Guide to Wealth’ (which I believe is one of your greatest books). At 22, it was the perfect time to acquire the book.

Since then, I’ve followed the advice religiously, including personal development, growing my earnings (including owning a business) and using cash flow productively.

As a result, my net assets increased from – $14,000 to just under 4.5 million in about ten years. So, thanks very much for your commitment to sharing knowledge and timeless wisdom; for anyone who takes action on your advice, the dividends are greater than ever imagined.

And finally

An Irish mother’s letter to her son.

Screenshot

Dear Son,

Just a few lines to let you know I’m still alive. I’m writing this letter slowly because I know you can’t read fast.

We are all doing very well.

You won’t recognise the house when you get home – we have moved. Your dad read in the newspaper that most accidents happen within 20 miles from your home, so we moved 30 miles away.

I won’t be able to send you the address because the last Irish family that lived here took the house numbers when they moved so that they wouldn’t have to change their address.

This place is really nice. It even has a washing machine. I’m not sure it works so well though: last week I put a load in, pulled the chain and haven’t seen it since.

Your father’s got a really good job now. He’s got 500 men under him – he’s cutting the grass at the cemetery.

Your sister Mary had a baby this morning but I haven’t found out if it’s a boy or a girl, so I don’t know whether you are an auntie or an uncle.

Your brother Tom is still in the army. He’s only been there a short while and they’ve already made him a court martial!

Your Uncle Patrick drowned last week in a vat of whiskey in the Dublin Brewery. Some of his workmates tried to save him but he fought them off bravely.They cremated him and it took three days to put out the fire.

I’m sorry to say that your cousin Seamus was arrested while riding his bicycle last week. They are charging him with dope peddling.

I went to the doctor on Thursday and your father went with me. The doctor put a small tube in my mouth and told me not to talk for ten minutes. Your father offered to buy it from him.

The weather isn’t bad here. It only rained twice this week, first for three days and then for four days.

Monday was so windy one of the chickens laid the same egg four times.

About that coat you wanted me to send you: your Uncle Stanley said it would be too heavy to send in the mail with the buttons on, so we cut them off and put them in one of the pockets.

John locked his keys in the car yesterday. We were really worried because it took him two hours to get me and your father out.

There isn’t much more news at this time. Nothing much has happened.

Your loving Mum.

P.S. I was going to send you some money but I had already sealed the envelope.

I hope you have enjoyed the latest edition of Noel News.

I hope you have enjoyed the latest edition of Noel News.

Thanks for all your kind comments. Please continue to send feedback through; it’s always appreciated and helps us to improve the newsletter.

And don’t forget you’ll get more regular communications from me if you follow me on X – @NoelWhittaker.

Noel Whittaker